How to overcome third-party data limitations to improve your brand’s KPIs and bottom line

Almost half of a brand’s ad budget goes to various forms of TV, including cable, broadcast, syndication, satellite, and DRTV. And most of the budget is managed by big media agencies such as WPP, Omnicom and Publicis, who primarily rely upon broad Nielsen audience data for the media planning. Given today’s audience fragmentation and the proliferation of channels and viewing platforms, allocating your TV budget efficiently is complex and challenging–but it can be done. For any media planner or brand marketer seeking to reach a specific audience subset, understanding and overcoming the limitations of broad third-party data approaches is the key to maximizing your TV spend efficiency.

Nielsen™ ratings: what works, what doesn’t

Media buying agencies aim to deploy the best possible data and resources to make the right buys for their clients, but options for third-party data are slim so most agencies rely on Nielsen audience data or TV ratings points (TRP). Both are estimated from program and station viewership samples gathered across different geographical and demographic sectors. The key point here is “estimated” and sometimes estimates are not reliable.

Nielsen uses a device called a People Meter to measure the TV and cable viewing habits of a representative sample audience. Attached to the back of a TV set, it records the time for each program and channel that a viewer watches on a particular day. An average is then taken for a 30-day period, providing the viewership status for that program and channel. TRPs provide an estimation of the “reach x frequency” efficiencies for a broad range of target audiences, however the reliability of the sample audience reach and viewership declines sharply when one tries to extract the information for a narrowly defined target with specific demographics and location attributes. In most cases, the granularity is at only an age group and gender level with limited information about other behavioral and psychographic attributes.

So the question is: does this broad representative audience data get you to your intended audience?

Agencies generally take a few approaches to figure out station-level TV buying and planning strategies based on the audience viewership data, including audience reach maximization and overlaying spend and reach data to viewership data at a daily or weekly level.

Audience reach maximization: Good for broad reach, bad for your budget

Audience reach maximization is the most widely used approach by buyers and planners to determine how efficiently a campaign and its media partners reach unique audiences. The downside to this approach is that the media plan takes into consideration a broad audience, which could behave quite differently than the narrower audience subset that brands actually intend to reach.

Unfortunately, there is no straightforward way to align Nielsen audience reach estimation for a given set of TV stations with the effective target audience reach for a specific brand. The price of any station’s ad spot is driven by the size of the general audience reach which could differ from a brand’s interest.

So, following a general or loosely defined target audience maximization approach can consume your media budget very quickly without effectively reaching your intended target audience. For example, TBS primetime might be more effective for a specific brand than CBS primetime, despite CBS’ wider general audience reach. Planners might make an uninformed decision to buy spots on CBS and quickly exhaust the budget without reaching their goal, which could have been accomplished by spending the same budget on TBS. There are many other ways for TV budget allocations to go wrong when the focus is maximizing general audience reach.

Overlaying spend or TRPs: Easily executed, high degree of inaccuracy

Overlaying TV spend or TRPs to sales or audience viewership is another allocation method.

While this approach is simple and easy to execute, it’s also limited. For example, how do you distribute TV effects across numerous stations that are concurrently running your ads? And how do you tackle the long-term effects of TV? For most brands, it’s very unlikely that any audience would make buying decisions immediately after seeing their ad. Other marketing activities, such as promotions and email, may also be influencing buying decisions. Unless planners consider all these factors concurrently, there could be a high degree of inaccuracy in assigning credits to individual TV stations.

Attaining the true effect of your TV allocation on your brand’s bottom line

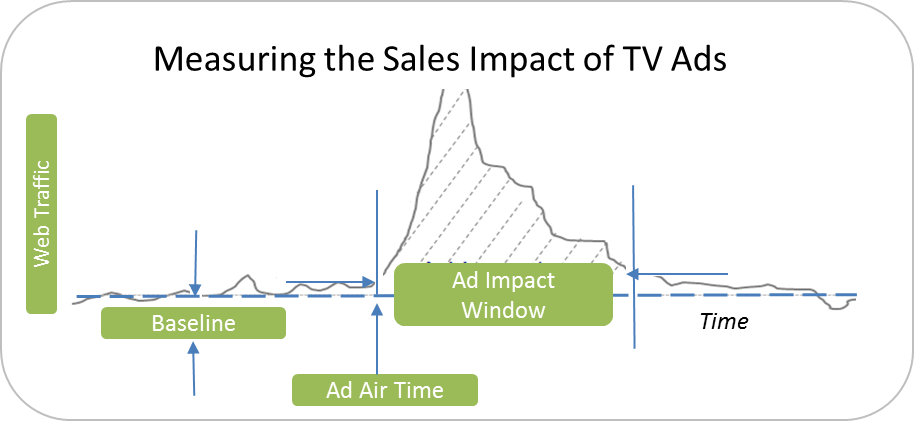

To tackle these general approach limitations, media analytics needs a method that detects the true effect of TV on a brand’s sales, number of units, or other key performance indicators (KPIs). A much cleaner and actionable approach is to overlay the data to arrive at an immediate relationship between TV activities and sales or viewership. This maximizes your primary brand goal for a certain TV campaign without boosting the wrong proxy variable such as general audience reach or viewership.

Maximizing your brand’s KPI as a function of the TV budget allocation across stations or other denominators is indeed a complex statistical approach, especially when hundreds of TV stations are available. But, it’s doable. Over the last few years, technology and statistical capabilities have advanced significantly and advanced attribution is a reality now. The positive side of a robust and systematic approach to tackling TV analytics is that brands can now learn the true effects of TV and optimal budget allocation while factoring out non-TV factors, seasonal trend, organic growth, and competition effects.

We’ve taken this approach for our clients and we can do the same for you. Contact us to learn more.

About the Author:

Haren Ghosh, founder and CEO of Analytic Mix, is a research industry veteran with more than 20 years of expertise in delivering client-centric predictive media analytics.